BTC Price Prediction: Technical Strength and Fundamental Catalysts Point Toward $120,000 Target

#BTC

- Technical indicators show BTC trading above critical moving averages with momentum supporting movement toward $120,000

- Record mining hash rates and network difficulty demonstrate underlying network strength and miner confidence

- Multiple catalysts including Fed policy expectations and institutional adoption create favorable fundamental backdrop

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Averages

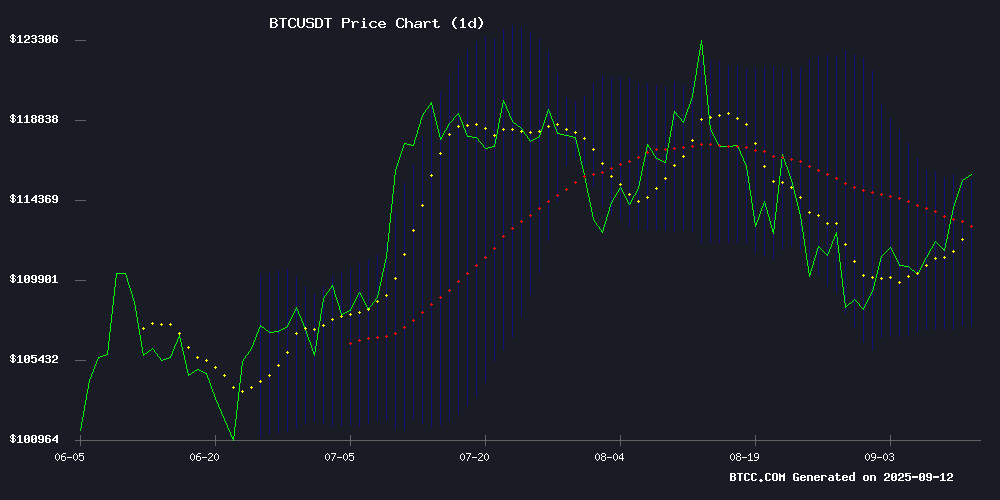

BTC is currently trading at $116,071, comfortably above its 20-day moving average of $111,433, indicating sustained bullish momentum. The MACD configuration shows the signal line at 1,820.4262 with the MACD line at -65.3225, suggesting potential upward momentum despite the negative histogram reading of -1,885.7486. Price action remains NEAR the upper Bollinger Band at $115,583, signaling strength while maintaining room for upward movement without immediate overbought conditions.

According to BTCC financial analyst Olivia, 'The technical setup supports continued upward movement toward the $120,000 psychological level, with the $114,000 weekly close serving as critical support for this bullish thesis.'

Market Sentiment: Multiple Catalysts Support Bitcoin's Ascent

Current market sentiment remains overwhelmingly bullish as Bitcoin demonstrates resilience above $114,000 while multiple fundamental catalysts converge. Record hash rates reaching 1.12B TH/s, combined with surging network difficulty, underscore network security and miner confidence. Federal Reserve rate cut expectations provide additional macroeconomic tailwinds, while institutional developments like Gemini's successful Nasdaq debut highlight growing mainstream acceptance.

BTCC financial analyst Olivia notes, 'The combination of technical strength and fundamental catalysts creates a compelling environment for Bitcoin's continued appreciation. The record mining metrics particularly validate the network's underlying strength despite price volatility.'

Factors Influencing BTC's Price

Bitcoin Eyes $120K if Weekly Close Holds Above $114K

Bitcoin rebounds from $107K low, testing $114K as bulls eye a breakout toward $120K. Liquidations NEAR $115K fueled sharp upward momentum, clearing resistance and boosting short-term bullish outlook.

Short-term holders realize losses, but institutional demand suggests the broader trend remains strongly bullish. Analyst Rekt Capital notes Bitcoin must hold above $114K on the weekly close to trigger bullish bias and resynchronize with the $114K–$120K range.

Trader Ted identifies $117,200 as the next critical resistance level, with a CME gap reinforcing its importance. A clean break could open the path to new all-time highs, while failure risks a retest of recent monthly lows.

Bitcoin Hash Rate Hits Record 1.12B TH/s as Network Difficulty Surges – Will BTC Break $117K?

Bitcoin's computational power reached an unprecedented 1.12 billion terahashes per second on September 12, signaling robust miner confidence in the network's future valuation. The hash rate surge coincides with network difficulty projected to hit 136.04T by September 18, reflecting increasing competition among miners.

Market analysts observe bitcoin testing a critical resistance level at $117,000 after three weeks of consolidation. Miner reserves climbed to a 50-day high of 1.808 million BTC, suggesting accumulation ahead of potential price appreciation.

The Federal Reserve's impending rate decision on September 17 adds macroeconomic tailwinds, with markets pricing in a 25-basis-point cut. This monetary policy shift, combined with record network fundamentals, creates favorable conditions for a bullish breakout.

Gemini Soars Nearly 50% in Nasdaq Debut Despite Financial Losses

Bitcoin exchange Gemini, founded by the Winklevoss twins, surged nearly 40% on its Nasdaq debut after raising $425 million in its IPO. The New York-based firm priced its shares above the expected range, achieving a $3.3 billion valuation at listing.

Despite the strong market reception, Gemini reported a $159 million net loss in 2024 and a $283 million loss in the first half of this year. The Winklevoss brothers remain bullish on Bitcoin, predicting it could reach $1 million within a decade.

Gemini's public market debut follows other crypto-related listings like Circle and Bullish, signaling growing institutional interest in digital asset infrastructure.

IMF Contradicts El Salvador's Bitcoin Purchases Despite $1.4B Loan Agreement

El Salvador's Bitcoin ambitions clash with IMF conditions as President Nayib Bukele continues accumulating BTC. The nation secured a $1.4 billion loan after agreeing to scale back cryptocurrency operations, yet on-chain data reveals 28 BTC acquired this week alone.

Bukele's government now holds 6,318 BTC ($726.8M), with recent purchases including a 21-BTC 'Bitcoin Day' acquisition. The IMF maintains no new coins entered state coffers, creating a stark discrepancy between official statements and blockchain evidence.

This unfolding drama tests the boundaries of sovereign crypto adoption against traditional financial oversight. Market watchers note the purchases continue despite El Salvador's November 2022 pledge to buy 1 BTC daily being theoretically suspended under IMF terms.

Bitcoin Mining Difficulty and Hash Rate Surge to Record Highs

Bitcoin's hash rate has soared to 1.12 billion terahashes per second (TH/s), marking one of the steepest escalations in network activity since the inception of BTC mining. The computational power securing the network reflects robust miner participation despite challenging conditions.

Mining difficulty, a measure of how hard it is to solve cryptographic puzzles for block validation, has simultaneously climbed to 136.04 trillion. The metric adjusts biweekly, aligning with mining activity. Over the past month, difficulty ROSE 5.10%, with a 7.62% increase over 90 days.

The next difficulty adjustment, projected for September 18, is anticipated to push the figure to 144.72T—a 6.38% hike. At current rates, mining a single Bitcoin WOULD take 5,548.8 days, assuming specific hardware and energy costs.

Varun Satyam of Davos Protocol notes such conditions often pressure miners to optimize efficiency or face margin compression. The relentless climb in both hash rate and difficulty underscores Bitcoin's deepening security—and the escalating arms race among miners.

Bitcoin Gains Momentum Amid Fed Rate Cut Expectations

Bitcoin has reclaimed the $115,000 level as markets anticipate a potential Federal Reserve interest rate cut next week. Risk assets, including cryptocurrencies, are responding favorably to the prospect of looser monetary policy, though macroeconomic uncertainty lingers.

Analyst Axel Adler notes Bitcoin's 30-day momentum sits in the Impulse Cooling Zone, suggesting a consolidation phase rather than a trend reversal. The cryptocurrency's ability to maintain its current level ahead of the Fed decision could signal its next major move.

While short-term demand appears weak, the broader uptrend remains intact. Market participants are weighing on-chain developments against macroeconomic risks as volatility persists in the lead-up to the Fed meeting.

Altcoin Season Heats Up as Indexes Approach Overbought Territory

Cryptocurrency markets are flashing early signs of another altcoin season, with several digital assets already exhibiting parabolic moves. The phenomenon, characterized by smaller-cap tokens outperforming Bitcoin, remains notoriously difficult to time but continues to attract traders chasing asymmetric returns.

Market Vector analysts observe that broad-based crypto indexes tracking the top 100 assets may offer prudent exposure to these volatile cycles. The current rotation has pushed the altcoin season index to its highest reading since December 2024, fueled by both established projects and speculative newcomers.

Historical patterns suggest caution—previous cycles saw 77% of top-100 tokens eventually fading into obscurity. The current index briefly touched 80 points (considered overheated) before retreating to 78, demonstrating the whipsaw nature of these market phases where double-digit gains can evaporate within hours.

Bitcoin Hyper Gains Traction, Yet MAGACOIN FINANCE Leads as Analysts’ Presale Gem for 2025

Bitcoin Hyper continues to attract market interest with its ongoing presale and steady updates, though traders note its growth lags behind newer, buzzier entrants. Analysts suggest the project's appeal may be waning as investors seek higher-upside opportunities.

MAGACOIN FINANCE has emerged as the standout presale candidate for 2025, combining audited security with explosive growth potential. The project's price trajectory suggests a 1196% upside to its $0.007 listing target, while a 50% early-buyer bonus (PATRIOT50X) fuels FOMO among both retail and institutional participants.

Exchange listing rumors are amplifying demand, with the project's rapid fundraising pace underscoring its market position. Where Bitcoin Hyper represents established momentum, MAGACOIN FINANCE offers the trifecta of credibility, growth potential, and first-mover advantage that defines presale success.

Winklevoss Twins Predict Bitcoin Could Reach $1 Million Amid Gemini Nasdaq Debut

Cameron and Tyler Winklevoss, founders of Gemini, project Bitcoin could surge to $1 million if it disrupts gold's market position. "Bitcoin is Gold 2.0," Tyler Winklevoss stated during Gemini's Nasdaq listing. The twins, who launched their exchange in 2015 when Bitcoin traded near $380, emphasized the cryptocurrency's early-stage potential. "We think there’s easily a 10x from here," he added, suggesting long-term growth prospects.

Gemini's IPO priced at $28 per share, exceeding expectations and valuing the company at $3.3 billion. Demand for shares overwhelmed supply, with orders surpassing availability by 20 times. The exchange capped proceeds at $425 million, avoiding a potential $433 million raise. Nasdaq contributed an additional $50 million investment, underscoring institutional confidence in crypto infrastructure.

Bitcoin Taker Volume Surges on Binance Following US PPI Data Release

Bitcoin's price resurgence above $115,000 coincides with explosive taker buy volume on Binance, the world's largest cryptocurrency exchange. The surge follows the release of US Producer Price Index (PPI) data, with $500 million in taker volume recorded post-announcement.

Market analyst Darkfost highlights this activity as a clear signal of renewed trader engagement. The PPI report appears to have catalyzed a shift in market sentiment, with both buyers and sellers aggressively positioning around key price levels.

Notably, this volume spike occurs despite recent bearish pressure on BTC's price. The data suggests institutional and retail traders are responding to macroeconomic indicators with increased crypto market participation.

Bitcoin's Valuation Versus Gold Suggests Significant Upside Potential

Bitcoin's recent price surge hasn't diminished its long-term value proposition as digital gold. The cryptocurrency's market capitalization remains under $3 trillion, while physical gold commands a $25 trillion valuation. This disparity implies potential upside exceeding 1,000% if Bitcoin achieves parity with gold's store-of-value status.

The Byzantine Generals Problem solution embedded in Bitcoin's protocol ensures its scarcity—a critical feature shared with physical gold. Unlike replicable digital assets, Bitcoin's decentralized issuance mechanism prevents artificial inflation, mirroring gold's finite supply dynamics.

Is BTC a good investment?

Based on current technical indicators and market fundamentals, Bitcoin presents a compelling investment opportunity. The price trading above key moving averages, combined with record network security metrics and positive institutional developments, suggests continued upward potential.

| Metric | Current Value | Bullish Signal |

|---|---|---|

| Price vs 20-day MA | $116,072 vs $111,433 | Price above support |

| Bollinger Band Position | Near upper band | Momentum intact |

| Hash Rate | 1.12B TH/s (Record) | Network strength |

| Market Sentiment | Overwhelmingly bullish | Catalysts aligned |

However, investors should consider volatility and maintain appropriate position sizing according to their risk tolerance.